Paper gold price manipulation — Rigged to fail

07/13/2022 / By News Editors

The current and open fraud regarding the paper gold price in the COMEX market is now as plain to see as the open desperation in the global financial system, which is unraveling in real-time all around us.

(Article by Matthew Piepenburg republished from GoldSwitzerland.com)

As risk assets tumble foreseeably into bear territory before a headwind of deliberately rising rates, precious metals have seen headline-making falls as well.

Below, we explain why.

Tracking the Paper Gold Price —The Standard Answer

In prior reports, we’ve noted that precious metals typically behave sympathetically when markets tank; thereafter, gold then surges north. We saw this pattern in October of 2008 and March of 2020.

Furthermore, when a Hawkish Fed pursues a temporary yet face-saving policy of rate hiking and quantitative tightening, this makes the USD the relatively stronger horse in the global currency glue factory.

And a relative rise in the USD, of course, is a headwind to gold.

Explaining the Paper Gold Price — The Rigged Answer

But let’s get to the real heart of the matter, namely: Legalized paper gold price manipulation (i.e., fraud) in the COMEX market, a topic we’ve addressed more than once, here and here.

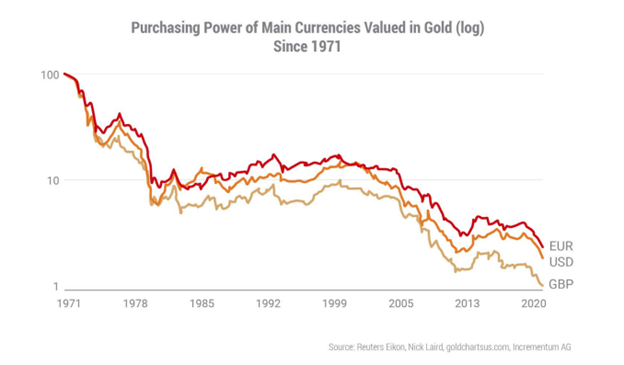

As we’ve openly argued for years, nothing embarrasses an otherwise discredited fiat currency like a rising gold price.

As I’ve described it, rising gold prices are a middle finger to debased currencies whose declining purchasing power are the DIRECT result of the failed and drunken monetary policies (i.e., mouse-click trillions) of a central bank near you.

Or as Ronan Manly more distinctly observed: “Gold to central bankers is like sun to vampires.”

And that, folks, is precisely why the big banks (under the direction of the BIS) are deliberately (and if law school serves me correctly) as well as fraudulently manipulating the paper gold price.

Facts vs. Manipulation

In the first quarter of 2022, we saw record high purchases of ETF gold, physical gold and central bank gold. Even Goldman Sachs’ head of commodity research was targeting $2400 gold this year.

Instead, the gold price has been falling as gold demand has been rising.

Huh?

It reminds me of 2008 when mortgages were defaulting en masse yet the ABX index for sub-prime mortgages was rising.

In short, complete (and temporary) manipulations were going on behind the curtains of a few wayward banks, including Morgan Stanley.

Today’s gold behavior (i.e., surreal manipulation) is no different and no less of an insult to the natural forces of supply and demand, which central bankers have attempted to destroy for well over a decade.

But the jig will soon be up on these masters of open fraud and Wall Street socialism.

The Paper Gold Price & The Horse’s Mouth

For now, and in case you fear I’m just acting as a “gold bug” apologist, let’s go straight to the horse’s mouth and examine the confessions and facts of open price manipulation in the precious metal markets.

And I swear, you really can’t make this stuff up, it’s just that obvious and distorted.

In a recent article by Peter Hambro published by the British news site, Reaction, a 3rd generation gold insider (Petropavlovsk, Bank Hambros) made the open secret of paper gold price manipulation abundantly clear and incontrovertible.

It’s also worth adding that Mr. Hambro’s entire career was that of an heir to a banking dynasty all too familiar with the insider machinations of the London bullion markets and London Stock Exchange.

In short, when Mr. Hambro discusses gold price manipulation, it’s worth listening.

A Chart Says a Trillion+ Words

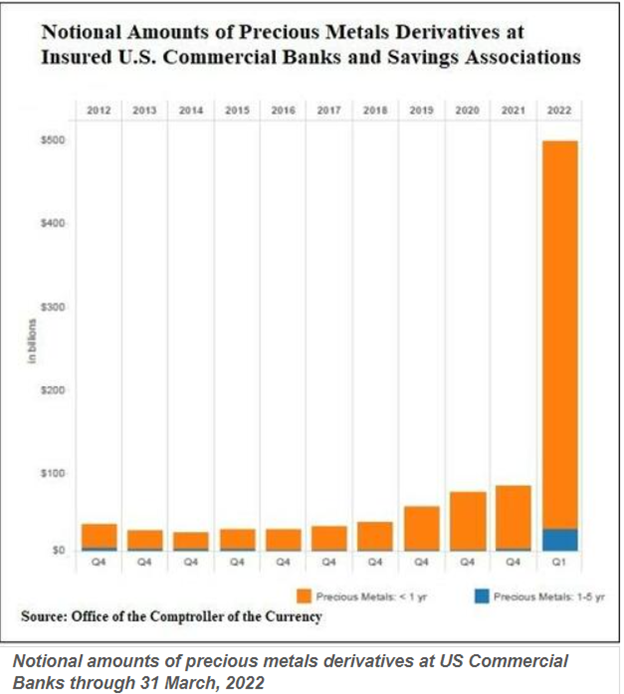

More importantly, and for those who prefer facts over human confessions or “gold bug whining,” the following chart from the U.S. Office of the Comptroller of the Currency (OCC) clearly reveals the extreme extent by which just a handful of highly pocketed (and central bank supported) banks like JP Morgan and Citi can use extreme turns of derivative-based leverage to short (i.e., keep a permanent boot to the neck of) the paper gold price:

That rising bar on the far right is nothing more than crime scene evidence.

As Hambro remarks, a long history of media and bank supported mis-information has tried to keep a lid on the desperate attempts by just a small number of BIS minion banks like JP Morgan and Citi to effectively prevent free market price discovery on the paper gold price.

Despite thousands of daily long contracts (i.e., buy orders) in the OTC forward contract markets, if just 7-8 banks wish to use massive leverage (rising bar on the right) to short the same metal, they can effectively fix the gold price via artificial manipulation of derivatives contracts, to which only a small number of banks have access.

All of this open yet legalized fraud is managed by the central-banks central bank, namely the Swiss-based Bank for International Settlements.

As Hambro states, and as taken from a recent article published by Ronan Manly:

”[s]ince 2018 the Financial Stability Desks at the world’s central banks have followed the Bank for International Settlements’ (BIS) instruction to hide the perception of inflation by rigging the gold market.”

Hambro further observes:

“With the help of the futures markets and the connivance of the Alchemists, the bullion traders – yes, that includes me, I was Deputy Managing Director of Mocatta & Goldsmid – managed to create an unshakeable perception that ounces of gold credited to an account with a bank or bullion dealer were the same as the real thing. ‘And much easier, old chap! You don’t have to store or insure it’”.

So, there you have it: Banks acting badly, very badly.

No shocker there…

The Greenlight from Big Brother

In essence, a handful of 7-8 LBMA institutions creates an almost limitless amount of synthetic paper representing unallocated gold (i.e., gold they don’t actually own) to short the paper gold market.

Why?

Again, because the central bankers mouse-clicking and hence destroying trillions worth of sovereign currencies (since Nixon took the gold chaperone away in 1971) are utterly terrified of a neutral and relatively fixed/scarce monetary metal like gold—i.e., real money.

Indeed, gold is money, the rest is just debt and toilet paper masquerading as currency.

Furthermore, the policy makers (or central controllers) are embarrassed to confess the inflationary consequences of their absurd money printing, and nothing reveals those consequences more than a naturally rising gold price.

Solution?

Easy: Lie about inflation and rig the paper gold price with leverage, derivatives and a greenlight from the BIS, aka: “Big Brother.”

In Rigged to Fail, I revealed how central bankers rig the bond and hence stock markets. Here we are just showing you how the same bankers rig the gold price to hide a failed currency market.

And if you want to put a handsome face to the farce, here’s an unforgettable one:

What About Don’t Fight the Fed?

Of course, most of you may be angry yet not the least bit surprised to see such rigging hiding in plain sight.

And even if your eyes have been (or now are) wide open, you’re also likely to say, “great, thanks for the news, but how the heck can we (or gold) fight all the central banks?”

Fair question.

As I’ve said, even if you know about a dirty cop, there’s almost no point in fighting one, right?

The Jig (Rig) is Up

We may be a bit jaded and realistic, but that doesn’t make us naive. Gold will get the last and honest laugh over such a corrupt and dishonest “policy.”

As central banks continue to lose more and more credibility, and as investors become more and more fluent in, and aware of, the absurdity of the lies that have been sold to us for years by central bankers and MMT midgets who claim that a debt crisis can be solved with more debt, which is then paid for with trillions created out thin air, the system unwinds.

As the inevitable inflation crisis emerges from precisely such absurd “policies,” the central bankers can no longer blame the obvious and long-dated/repressed inflationary consequences of their drunken monetary policies on a virus or Putin.

Nor can they continue to peddle the lie that inflation was merely “transitory,”a fact we made clear long before Powell confessed it was not so.

Stated otherwise, more and more folks are catching on to the fraud.

The math plainly shows that expanding the broad money supply (and central bank balance sheets from $6T to $36T in just over a decade) is the real cause of the inflation in your neighborhood and the debasement in your wallet.

The First Cracks & the Last Straws

Geopolitical shifts, assassinated prime ministers, fired prime ministers, angry truck drivers, stormed capitals and Sri Lankan protestors are just the first tragic cracks in a growing social unrest driven by declining wealth and growing wealth disparity, all classic and historic symptoms and patterns of when a debt crisis leads to a political crisis, and sadly (and ultimately) more centralized controls over our markets and lives.

But as even Hambro observes, eventually the last straw breaks the back of a rigged camel, and the “straws blowing in the wind are often said to presage great tempests and I believe that {the chart above] shows just such a straw.”

Years of distorted, rigged and entirely reckless debt-and-print polices have made global economies and currencies weaker, not stronger.

The weaponized USD in the wake of the failed Putin sanctions is just further proof of how weak Western economies have become.

Dying Faith, Rising Gold

After years of profligate central bank policies, the so-called “developed economies,” which are now little more than glorified banana republics, are losing credibility, options and most importantly public faith.

This is critical.

In the end, when faith in a system ends, so does its currency.

We’ve written before how impossible it is to market time “the end of faith,” but charts like the one featured herein help to point out the rigging and hence accelerate the inevitable end to derivatives-based fraud, centralized price-fixing and, eventually, the OTC casino in particular.

Meanwhile, the current buy window for repressed precious metals is remarkable, and once central banks cripple the markets to their deflationary pain points, chaos will return, along with the inflationary money printers—all of which will send precious metals higher and fiat currencies and markets to their mean-reverting lows.

Read more at: GoldSwitzerland.com

Submit a correction >>

Tagged Under:

big government, bubble, central bank, conspiracy, corruption, currency crash, deception, dollar demise, Federal Reserve, finance, gold, international bank, lies, manipulation, market crash, money supply, Precious Metals, rigged, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 METALS NEWS